Recently, finance companies was basically targeting physicians getting a form of financing not open to people called a health care provider real estate loan. Doctors features novel challenges which have borrowing from the bank while they provides large financial obligation-to-income percentages.

- Which qualifies having a physician financial?

- Pros and cons out-of medical practitioner fund

- Exactly what home loan amount you are going to be eligible for

- Common mistakes with doc mortgage loans as well as how to not ever build him or her

We designed this guide to incorporate facts out of several years of feel dealing with attendings and you can citizens while making your behavior smoother.

So, spend your time with this publication (and you will store it) to higher discover if the a doctor real estate loan ‘s the proper for your requirements when the time comes to buy your house. Look at this a quest for the means of knowledge and you can making an application for a physician mortgage.

As you know, medical professionals give up an incredible amount of time and energy compared to most other professions. Some of the other friends generate its stays in their 20s, your strive to complete your own training and you can degree.

You appear to also it is like someone you know are paying off. Should it be delivering ily life is happening all around your. Meanwhile, you happen to be evaluating patient maps on the a saturday night.

But, are https://clickcashadvance.com/installment-loans-or/jacksonville/ a health care professional is definitely worth now and you can lose, and soon now of the residence grind is about your. You are going to start making big lifestyle solutions, even if you are receiving a later on start compared to the everyone otherwise.

Physician Mortgage loans: What you need to See

And you may, as you prepare to acquire a home, you have to know a health care professional home mortgage. This will be one of the several benefits associated with as a health care professional, and it’s worth time to learn more about which mortgage product.

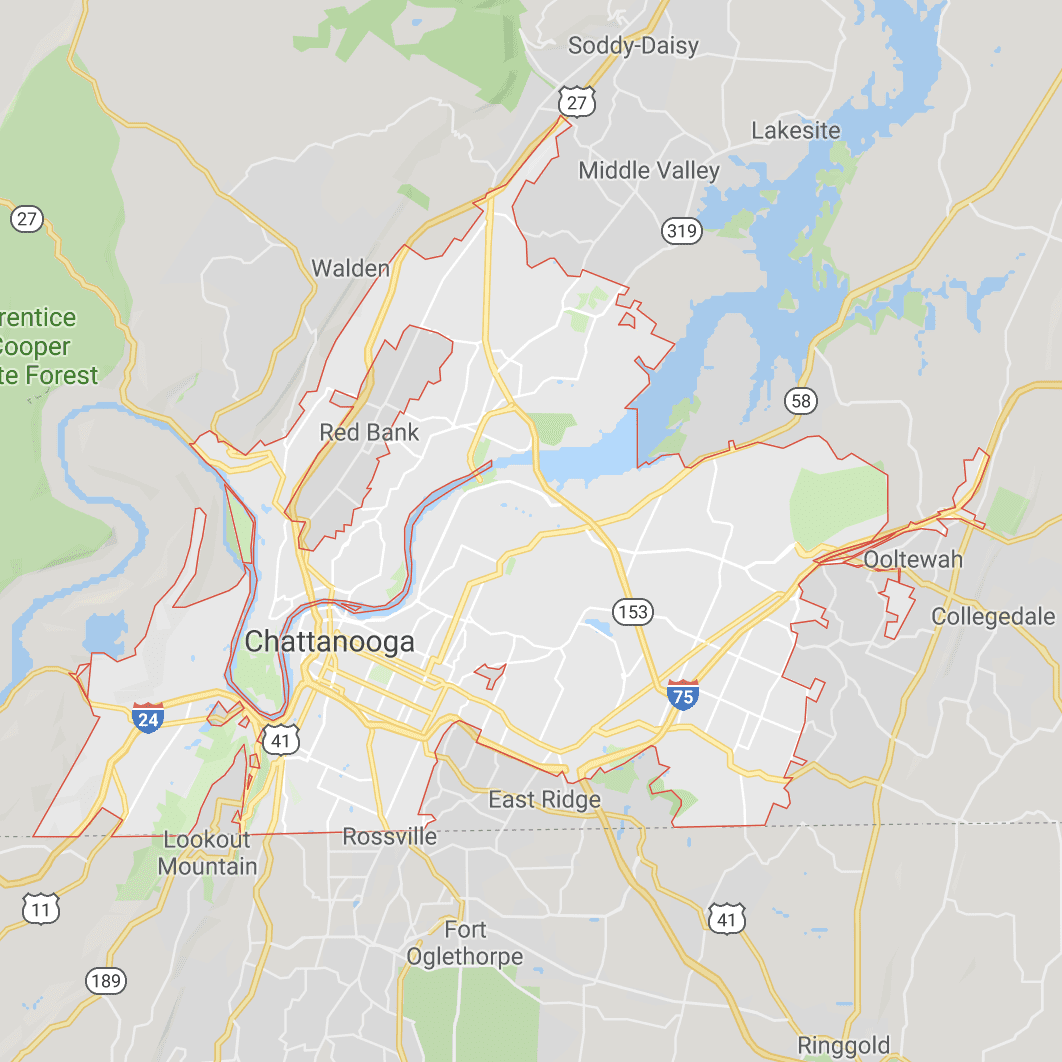

For people who simply just need certainly to find a very good medical practitioner domestic mortgage, simply click your state less than to find the best lender and you can rate towards you.

Quick Look for: The financial institution that helped all of us get the doctor mortgage is Doug Crouse, and we also Recommend doing work your.

You have heard about doctor mortgage loans, however, were not some sure the way they has worked and if they might even be a choice for you. Just who just was these types of money ideal for as well as how will they be other compared to conventional mortgage loans?

What exactly is a doctor Mortgage?

A doctor mortgage loan was another type of home loan product open to physicians. They do not have quite as many limits than the just what lenders wanted from borrowers off old-fashioned fund. If you have a significant credit score (doing 700 otherwise a lot more than), then you’ll pick a doctor financial causes it to be less and easier for customers and you may attendings to shop for a property with little to no money down and get away from private financial insurance policies.

An award winning Medical practitioner Mortgage Specialist Neil Surgenor at TD Financial stated, Doctor mortgage loans try a remarkable tool making it possible for doctors to operate the big date for the paying most other highest focus and you can non-tax-allowable financial obligation first whenever you are benefitting regarding special pricing and no financial insurance rates. Particular lenders will require off payments and only promote ARM’s (Adjustable rate mortgages) however some folks bring one hundred% funding and fixed rates.

One of the most significant benefits associated with the physician money is you is expose an offer page because the a proof coming earnings if you’ve not even come your position as the the full-go out going to medical practitioner. Or, you might introduce a duplicate of your own transcript if you are nevertheless from inside the degree.

Loan providers ft these fund towards the upcoming earnings, which makes them most appealing to physicians who are concluding its house otherwise which have just finished out of scientific college or university.